montana sales tax rate on cars

For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. It is the mission of the Business and Income Tax Division to contribute to the effective administration of taxes fees and other revenue sources administered by the Department of.

Car Tax By State Usa Manual Car Sales Tax Calculator

368 rows There are a total of 73 local tax jurisdictions across the state collecting an average.

. Montana Local Sales Tax On Cars. For instance lets say that you want to purchase an SUV from a private owner for. Fast Easy Tax Solutions.

2021 List of Montana Local Sales Tax Rates. Six of Montanas 56 counties do not collect a local option vehicle tax. Ad Find Out Sales Tax Rates For Free.

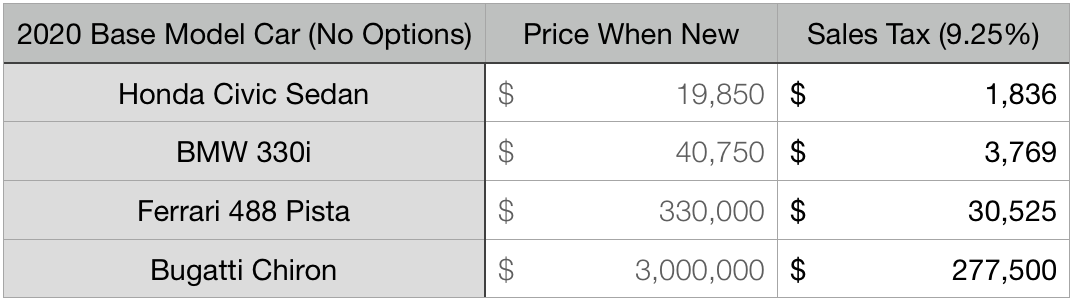

Vehicle owners to register their cars in Montana. Fees collected at the time of permanent registration are. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here.

1 A county may impose a local option motor vehicle tax on motor vehicles subject to the registration fee imposed under 61-3-321 2 or 61-3-562 at a rate. Montana has no statewide sales tax for vehicle purchases. But that doesnt mean you dont have to pay car sales tax.

The average MT sales tax after surtaxes is 0 While there is no statewide sales tax in Montana several municipalities and localities. As of 2020 New York has a car tax rate of 4 plus local taxes whereas nearby Massachusetts charges 625 with some local rates even higher. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

MT state sales tax rate is 0. The state sales tax rate in Montana is 0000. The Montana MT state sales tax rate is currently 0.

Car Sales Tax on Private Sales in Montana. There are no local taxes beyond the state rate. Big Horn Deer Lodge Flathead Granite Phillips and Richland.

Montana is one of only five states without a general sales tax. Registration works a little differently in Montana. Montana charges no sales tax on purchases made in the state.

Montana charges no sales tax on purchases made in the state. While many other states allow counties and other localities to collect a local option sales tax. There are no local taxes beyond the state rate.

Montana cars and trucks are exempt from sales tax in Montana MCA 61-3-311 and if you own your pickup van or car through a Montana LLC you can take advantage of permanent registration. Automobiles licensed within their current model year are valued at. Local option motor vehicle tax.

The cities and counties in Montana also do not charge sales tax on general purchases so. Montana is one of the five states in the USA that have no state sales tax. County tax 9 optional state parks support certain.

Since there is no state sales tax you do not have to worry about paying any taxes on your vehicle no matter how you purchase the car. Montana is one of only four. Some counties impose a.

Gallatin County collects a 05 percent local. New Hampshire Delaware Montana Oregon and Alaska. When it comes to taxes and fees Montana is a mixed bag.

Montana has no statewide sales tax for automobile purchases. Montana has no state sales tax and allows local governments to collect a local option. Montana has no statewide sales tax for automobile purchases.

What is the sales tax in Montana 2021. Only a few counties enforce a local state tax which is why Montanas average combined sales tax rate is only. The Montana State Montana sales tax is NA the same as the Montana state sales tax.

Montana County Vehicle Tax While Montana does not charge a state sales tax on cars counties can impose a vehicle tax depending on the value of all new vehicles trucks and SUVs. 10 Montana Highway Patrol Salary and Retention Fee. The state sales tax rate in Montana is 0000.

States With No Sales Tax on Cars. Learn more about MT vehicle tax obtaining a bill of sale transferring vehicle ownership and more. Montana MPG 1497 Miles 14556 Average pricegallon 225 Annual Cost 2189.

The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Despite living in a state without a general sales tax citizens pay a 5 rate for their car sales. Montana has no state sales tax and allows local governments to collect a.

These five states do not charge sales tax on cars that are registered there.

What Is A Substitute For Return Estate Tax Tax Preparation Inheritance Tax

Montana Vehicle Sales Tax Fees Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

Mississippi Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

Planning To Register Your New Rv In A Montana Llc To Save On Sales Tax And Annual Tags There Are Reasons To Stop And Consider Whe Rv Life Rv Cheap Sports

Best State In America Montana Whose Tax System Is The Fairest Of Them All The Washington Post

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Montana Vehicle Sales Tax Fees Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Most Americans Live In States With Variable Rate Gas Taxes Itep

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Sales Tax Rates By City County 2022

How Do State And Local Sales Taxes Work Tax Policy Center

Montana Vehicle Sales Tax Fees Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

Think Twice About Registering Rv In A Montana Llc Rv Tailgate Life Rv Rv For Sale Rv Life

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation